Businesses are a great way of making profits and earning revenues, but the major focus of a business is the clients. The products and services all depend on the customers’ demands and preferences. But the primary job to supply these products to the customers rightly is the duty of all the employees. The employees are the foundation stone for the company or the business.

Therefore, payroll processing has a significant importance in a business. Employees and employers must correctly understand the correct management, implementation, and related laws.

The business owners and HR departments’ prime responsibility is understanding their employees’ requirements. The employees must also thoroughly understand labor laws, payroll compliances, etc., to avail of benefits and identify their rights.

employees’ requirements

What is payroll processing?

First, let us discuss what payroll compliance is. The simple answer to that is the management of employee payment under legal laws and binding to the labor laws compliance. Payroll compliance mainly refers to the procedure related to calculating the exact amount of payment to be done to the employees based on their working hours. On top of that, keeping track of the taxes to be filed every year for the employee is also essential.

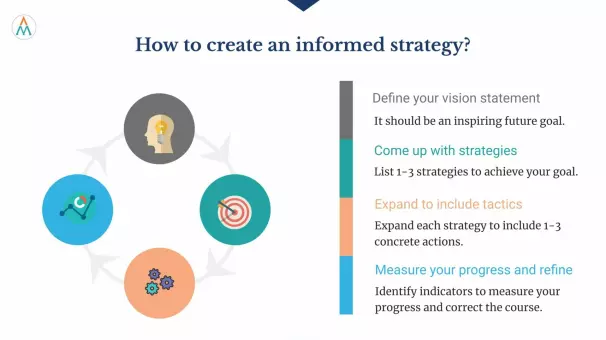

You may follow some payroll processing tips for a successful payroll management process. To improve the payroll management services, you can do as follows:

The first and most crucial step in payroll processing is to give a unique employer identification number, also known as the EIN.

The HR department or the one in charge of payroll must establish the tax IDs and get the financial information of the employee. This must be followed by setting up a schedule for payroll and giving the tax payment dates.

The manager must keep an eye on the hourly work or schedule of the employee and calculate the overtime pay if required by considering the labor laws and the minimum wages act.

It is also essential to set up the deductions or additions based on the gross pay and net pay, and the employer must make sure to provide the payment to the employee/worker according to the suitable method for them.

payroll processing tips

What are the labor law compliance rules in India?

Labor laws mainly include the necessary regulations and rules to be strictly followed by all businesses for their employment procedure. Labor law compliance is an umbrella term for all the acts passed by the state and the central government for employees. These laws include the following acts:

Minimum wages act, 1948- As the name suggests, it is the minimum salary the contractor must pay the appointed scheduled workers. The details about the act are given in section 12 and section 14. According to these sections, the contractor is liable to pay overtime charges if the worker does overtime and payment or salary is almost doubled.

Payment of Wages Act of 1937- It is among the most crucial employee wage laws. Under this act, the discussion of the fixation of wages is done. Also, it specifies the importance of maintaining the register and records so that there is proof of work and payment.

Building and other construction workers act, 1996 – This act is mainly applicable to specific situations where the number of workers is ten or more than that. The primary purpose of this employment law is to collect tax from the undergoing construction work and use it specifically for the well-being of the workers.

Contract Labour Act, 1970- There are specific conditions for this act to apply; that is, the number of workers must be 20 or more than that. The main focus of this act is to provide a controlled environment for the workers for contract labor. The primary requirement for this act to apply is that the company must be registered under this act.

Employment State Insurance Act- This scheme was mainly enacted for the overall security of society. This Act was passed in 1948. According to this Act, the employee is provided financial help during injury, disability, or maternity. However, it must be noted that this Act is a self-financing scheme. Therefore, financial help is provided from the previous monthly deduction of ESI from the employee’s salary. This law applies to any company or institution with more than ten employees. The employees must note that a minimum wage is required to become eligible for this scheme, i.e.Rs. 21,000 monthly.

Maternity Benefits Act – This act was passed in 1961 and is helpful for the well-being of women in the working sector. It ensures women’s safety and their jobs in the workforce during maternity. They are allowed paid leave during and after childbirth for a given period. Also, they are provided with some financial help.

Payment of Bonus Act, 1965 – Bonuses and rewards are a great way to encourage employees to work harder. Therefore, this act was passed so employees get bonuses for their hard work and overtime. At the time of payroll processing, the bonus is calculated based on the percent increase in the profit made by the company due to the individual’s contributions. It is applicable wherever the number of people is 20 or more than 20 in the workplace.

There are also other laws such as the Trade Union Act (1926), Industrial Disputes Act (1947), Dock Workers (safety, health, and Welfare) Act, 1986, etc.

What is the benefit of labor law compliance?

The labor laws are made to create a safe environment for the employees. It creates a decent working environment for the employees, and the rules are such that the employer cannot misuse their power. These laws make a minimum payment requirement for employees and set a minimum wage for all workers. Moreover, a safe working environment is provided at the workplace, motivating the employees. Disregarding these rules and regulations will lead to penalties and fines for the institution. Therefore, the employees must be in regular touch with the labor law updates and keep information about the labor law regulations so that no contractor can misuse their power.

labor law updates

Following are some of the benefits of labor law compliance:

Uniform payment – the laws set a minimum wage requirement and overtime compensation for all workers. This provides uniform and unbiased payroll processing for the workers.

Defined working hours – the minimum wages are based on defined working hours. Also, they get compensation payments for working overtime.

Employment security – The employees get a contract in writing before joining so the employers can’t misuse their powers in the future. The length of the probation period and notice period are all mentioned in the agreement, and the employee must pay a penalty if he breaks the deal.

Safe workplace – Some laws state the minimum safety requirements for the workers and employees in a particular workplace. The company cannot become functional if the safety standards are not fulfilled.

Equal treatment for all employees – The laws make sure to provide equal opportunities to all. The minimum wage, sexual harassment laws, and safety laws ensure a good working environment for all genders.

What will happen in case of non-compliance to laws?

Non-compliance with the laws will lead to heavy losses to the employees or employers and the organization. Compliance with laws will lead to mismanagement of data and non-uniform employee payment. This will lead to disputes among employers and employees.

Moreover, this will lead to legal actions against the company or organization and damage the company’s reputation as a whole.

Some of the legal actions are as follows:

Punitive fines or criminal proceedings

Significant damage to the reputation or credibility of the organization.

The organization may have to compensate the employee if they are underpaid.

What is the difference between labor law and employment law in India?

Many people often need clarification on the labor and employment laws in India. They may sound similar, but there is a considerable difference between them. The significant difference is that labor laws protect the rights of all workers in a workplace as a whole. However, employment law deals with employees and their rights. Let us discuss the difference in more detail as they are integral to HR and payroll compliance.

HR and payroll compliance.

Labor law

Both the labor laws and employment laws come under the payroll compliance guidelines. However, labor law regulations have a narrower base than employment law because the former is related to the workplace agreements between the employer and the workers union.

It establishes the right of strike for the workers in case of mismanagement by the employer and creates a balanced workforce in the company. It prevents any misuse of powers or harassment by HR, and payroll compliance is established for them.

Employment law

Unlike the labor law, here, the rights are reserved for an individual employee. There is direct interaction between the employer and employee, and groups, associations, or unions are not involved. Statutory compliance in HR ensures to present a written agreement keeping in mind the employment law and gets it signed by the employee.

Statutory compliance in HR

Importance of HR and Payroll compliance

To understand the importance of these two terms, we must know the basic information about them. HR compliance is one of the most critical tasks of the human resources department. Among all the other compliances, payroll compliance is essential as it deals with the payment procedure and deduction of taxes while paying the employees. Statutory compliance in HR deals with the various legal laws and regulations to be followed under different departments. Therefore, payroll compliance also comes as a part of this statutory compliance.

Stages in Payroll Processing

Payroll processing can be divided into three significant steps: pre-payroll, actual payroll, and post-payroll. These crucial steps can further be broken down into several stages, as mentioned below: –

Stage 1: Pre-payroll

These are the tasks that must be done before giving the actual salary to the employees. This may include steps such as registering employees, providing EIN (Employee Identification Number) for new employees, and reviewing done for existing employees.

The pay periods and payment methods are established according to the employee’s demands and are done after verifying their financial information and taxes. The HR department or the concerned department has to make some standards that the management must approve. Such standards include the establishment of payment standards, attendance criteria, bonus policies, leave policies, etc.

The next step in the pre-payroll process is getting all the required information. The calculation is done based on this information from various departments. Such information may include income tax declaration, salary structure, deduction of salaries, bonuses, attendance, etc. Such data can be managed better by using software for documentation.

The most crucial step is to verify the active employees’ data and discard the data of retired or inactive employees.

departments

Stage 2: Actual Payroll

The step that must be followed during the payment process to the employees is known as the actual payroll stage. These include calculations such as the employee’s gross pay, overtime compensation, etc. The net result will be the amount of salary that will be paid to the employee. The calculations and results must be verified thoroughly, as any error may lead to overpayment or underpayment to the workers or employees.

To facilitate this stage of payroll processing, the company may include a payroll system. The question here arises what is a payroll system? The payroll software is very capable of monitoring the employees’ working hours and also helps calculate taxes. The software is beneficial in removing manual errors and calculating payroll.

Stage 3: Post-payroll

This includes all the steps after the payment is made. The essential post-payroll activity is maintaining a register and recording all the payments made to different employees. It also includes generating payroll slips and reports, including payroll taxes.

The deductions such as EPF, TDS, and ESI are done. Therefore, after giving the salary, the deductions must be thoroughly reviewed.

Payout is also essential in payroll processing, verifying that the money rewarded reaches the proper account. Many companies also prefer to keep separate accounts known as employee salary accounts. It provides a hassle-free method to reward workers or employees’ salaries.

employees’ salaries.

Common Mistakes in Payroll Compliance

Maintaining the records and calculating pay for payroll processing is lengthy and time-consuming. It is a very tedious task, and thus, it is prone to get errors. These errors are more when the payroll is handled manually. However, using AI tools can significantly reduce the risk of errors; the condition is that all the data is correctly put into the system. For any company, it is essential to remember the common mistakes in payroll processing. The Procedure must adhere to the rules and regulations stated under the labor law and employment law.

Some of the most common mistakes are given as follows: –

Not classifying the employees correctly- All the employees get the advantages of the rules and regulations under payroll compliance. However, independent contractors do not get this benefit. Therefore, misclassifying an employee as an independent contractor will lead to his inability to access all the benefits under the employment act. This can also make the company liable to pay fines.

Also, exempt and non-exempt employees come under different categories and have other rights; therefore, mismanaging their data can lead to underpayment or overpayment. This will lead to financial losses for the company and break the rules.

Incorrect calculation of the wages -The incorrect calculation of wages or salary for the workers or employees may happen. This also leads to overpayment and underpayment to the individuals. There are several reasons for this error. If the overtime hours are not monitored properly, the wages may be miscalculated. It hampers the business’s financial statement and leads to an extra workload. The individuals in charge of the paycheck must spend hours daily to identify the errors and make the corrections accordingly.

False or incorrect records of working hours – To prepare paychecks, the organization needs to record the employees and workers. Whether it is the hourly workers or the salaried employees, their work hours must be monitored. If the working hours are not monitored and recorded correctly, it will lead to underpayment or overpayment to the employee. Moreover, the company will have to pay a fine.

Missing the deadlines for tax filing – Tax filing is significant and must be done precisely depending on individual employees’ paychecks. Any undue tax reduction may make the company liable to pay a fine.

The W-2 needs to be corrected – The employer keeps a record of the payroll. However, the employees must also keep a document for the payroll received. The W-2 is one such document; it is the only document the employee has as proof of the payroll. The employees use this W-2 in case of taxes, primarily annual taxes. But, maintaining such a W-2 document takes time and effort and often leads to errors.

Even minor errors can cause loss to both the employer and the employee. Therefore, the department in charge of payroll is responsible for maintaining the accuracy of the W-2.

Employers must know the basic rules and regulations and provide the required working environment. If the rules are broken, the company will be liable to pay the fine. Therefore, it becomes crucial to calculate the payroll very efficiently. This can be done by following the payroll processing tips and keeping regular labor and employment law updates. At last, the employees must be paid according to their hard work, which will result in the future benefit of the company.

rules

How to manage payroll without these common mistakes?

As the process of payroll compliance is written and calculated based on labor and employment laws, it becomes a tedious task. As a result, mistakes are bound to happen in such cases. If such documents are handled manually, then the frequency of errors increases even more. So, the following are some payroll processing tips by which one can avoid these common mistakes and ensure best practices by the employer: –

Making a checklist – Everything under the payroll process must be listed under a calendar, or there must be a proper list. The list must indicate the timing for each task under salary calculation.

It must have a definite period for paydays, filing taxes, making W-2 documents, etc. By making a checklist, one can plan which activity to do first and which activity can be done later.

Labor law updates – The HR team must constantly be in touch with any changes regarding the rules and regulations for the employee. Labor law regulations are updated from time to time. Therefore, the payroll must be prepared based on the updates to prevent future disputes.

Regular review process – The procedures and employees involved in the payroll processing must be regularly reviewed at defined intervals. It helps keep the system in check and allows getting hold of repeated errors. Experts can review such errors, and the system can be improved.

Establishing Policies – The employees or workers may get in dispute based on the confusion regarding the payroll process. Therefore, there must be a written manual with all the details about payroll processing. It must include all types of payroll activities. The most important payroll activities are the rules and regulations followed and the conditions under which exceptions are made. It must also include the requirements for providing bonuses or deductions.

Establishing Policies

Conclusion

All the above facts show that payroll processing is an important management task for the company. The employees are the foundation stones for the company; therefore, the company needs to reward them sufficiently for their hard work. Also, the company must pay overtime bonuses for the employees, which will encourage them to work hard. The salary is provided chiefly after deducting all the taxes and directly sent to the employee via cash, cheques, or bank accounts.

These payrolls are mainly calculated by abiding by labor and employment laws. The written agreement for maintaining discipline in distributing by following the rules and regulations is made to avoid any discrepancies or disputes in the future.