At the starting of the previous fiscal year, companies were moved to remote working and every employee started adjusting to the work-from-home office culture. Today, this culture has become commonplace and now we are more comfortable in this environment; (only until the pandemic subsides and offices reopen).

However, in between this chaos, a series of organizations faced issues with payroll. The HR team was given the task to motivate employees, engage them, and encourage them. In between these important activities, it not possible for the HR team to manually calculate payroll, dispatch salaries, and manage deductions.

Even regulations and laws are modified and incorporating these changing rules in your payroll structure is complicated.

In this article, we have discussed what payroll challenges small and medium organizations face and how payroll management services can help you mitigate issues.

Common Payroll Challenges Experience by Small and Medium Enterprises

There’s no doubt in the fact that payroll challenges are different for different organizations. Some may not get time and others may find it hard to deduct correct taxes. However, However, there are a set of common challenges in payroll processing. We have discussed 5 of these common payroll challenges below. Read on.

1. Compliance

Concerns around compliance have always been dominant in the payroll industry. In the global market as well, HR managers are always worried about filing taxes in a way to avoid compliance penalties. So, it is obviously one of the major challenges.

Everywhere HR managers struggle to navigate through complicated taxes and challenging tax calculations. Everything needs to be accurately calculated, processed on time, and submitted before the deadline. You miss one thing, or you neglect one little aspect and you are rushing down the hill towards compliance penalties.

Taxes are complicated and every small and medium organization requires support to automate calculations, avoid errors, and manage compliance.

2. Process Optimization

When your payroll processes are developed according to global standards, you may need to work extra hours. This is to say that too often, companies design processes that work according to global standards. While it is a great practice to work according to standards that are applicable everywhere, it is not always favorable in a small or medium organization.

You need to streamline your processes according to local compliance needs and employee payroll requirements. Although across the globe, there are some common standards for payroll, such as PPF deduction in one or the other forms, you need specific processes for your company.

If you implement everything which is followed globally, then you may force your HR team to work overtime to combine these with local requirements. For instance, a lot of your employees in India may not need insurance, or they may not want PPF deduction.

3. Real-Time Reporting

There’s no running away from reporting. Gone are the days when experts used to guess everything based on market results and decided payroll factors, such as pay-scale, appraisals, etc.

Today, we live in a different world, which is driven by young minds. Here, you need real-time reporting power to understand compliance, check audit problems, and analyze the occurrence of errors. You need to get to the source of things to mitigate problems.

You also need real-time reporting to understand various things:

Compliance structure

Payroll dispatch issues

Average payroll

Audit issues

Efficiency of payment

4. Confidentiality of Employee Data

As a small and medium organization, it is obvious that you are keeping the confidential and personally identifiable data of your employees in your office systems, hard drives, or pen drives.

The real question is, how secure are these data units?

Can you fully trust that no one will get into your system and steal all this data?

Security is a challenge – and no one can deny it. When you want to keep the confidential data of employees secure, you can’t keep working on tiring spreadsheets. You can fall prey to various issues, such as ghost employees, wrong wages, and faking insurance claims.

You need proper management of your employee data to avoid data leaks and mishandling. Every small and medium organization requires internal controls to securely access critical data and avoid unauthorized access to this data.

To start with, not every employee should be allowed to access every data file.

Every employee should be allowed to check data related to them, not everyone else.

Tax information and salaries of every employee should be perfectly concealed.

No outsider should get access to your data under any circumstances.

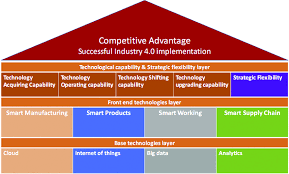

5. Technology Use and Automation

Adoption of technology and automation is still too far in the payroll industry. With the pandemic bringing us all down, thousands and thousands of organizations started using the cloud and automation technology to reduce the load of repetitive tasks and focus on strategic roles.

However, technology adoption has always been an issue in the payroll industry. Either the technology is too costly, or there’s a lack of trust in these systems.

Employee Classification and Benefits

Employee classification and benefits refer to the process of correctly identifying and categorizing employees based on their employment status and providing them with appropriate benefits and entitlements. This is a crucial aspect of payroll management for small and medium enterprises.

Employee classification involves determining whether an individual is an employee or an independent contractor. Proper classification ensures compliance with labour laws and determines the tax obligations and benefits the employee is entitled to. Misclassifying employees can lead to legal and financial consequences like penalties for non-compliance and the denial of benefits.

Once employees are accurately classified, providing them with the appropriate benefits is essential. This includes benefits mandated by labour laws like minimum wage, overtime pay and statutory leaves (e.g., vacation, sick leave) and additional benefits offered by the employer (e.g., health insurance, retirement plans). SMEs need to understand the legal requirements and ensure compliance while considering the financial capacity of the business.

Managing employee benefits involves administering and tracking various components like enrolment, eligibility and contribution management. It requires maintaining accurate records of employee hours worked, leaves taken and other relevant data to calculate and provide benefits accurately.

SMEs may face challenges in keeping up with changing regulations, especially if they have limited resources and expertise in HR and payroll. Staying informed about labour laws and seeking professional guidance can help SMEs ensure proper employee classification and benefits administration, foster compliance, and maintain a positive working relationship with employees.

Addressing Payroll Inquiries and Resolving Employee Concerns

Addressing payroll inquiries and resolving employee concerns can be a significant concern for small and medium enterprises for various reasons. Here are some key factors that contribute to this challenge:

Limited resources – SMEs often have limited staffing and resources. With a small team responsible for multiple functions, it can be challenging to allocate sufficient time and resources to promptly address and resolve payroll inquiries and employee concerns.

Lack of expertise – SMEs may not have access to specialized payroll professionals or HR staff with in-depth knowledge of payroll processes and regulations. This lack of expertise can hinder their ability to handle complex payroll inquiries or address specific concerns effectively.

Complexity of payroll -Payroll processes can be intricate as it involves multiple calculations, deductions, tax withholdings and compliance requirements. SMEs may struggle to navigate through these complexities, which may lead to errors, delays and difficulty in resolving employee concerns accurately and in a timely manner.

Time constraints – SMEs often have competing priorities and tight deadlines. This can make it challenging to dedicate sufficient time and attention to address employee concerns promptly. Additionally, delays in resolving payroll inquiries can lead to frustration among employees and affect their morale and productivity.

To overcome these challenges, SMEs can consider outsourcing payroll management to professional payroll service providers.

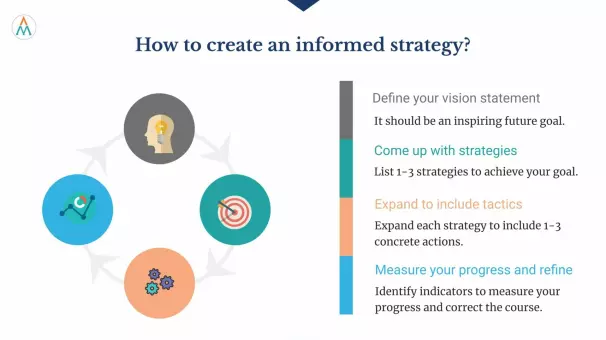

How Can We Deal with Post-COVID Changes?

At the onset of the COVID-19 pandemic, payroll management services were highly disrupted. In a small or medium organization, most of the activities related to payroll are dependent on a single person or a very, very small team. This team may have been enough before COVID-19 because these people only had the responsibility of managing payroll.

With an increase in remote working or hybrid working models, it is now the responsibility of the HR manager to keep the team together. Not only do they need to conduct tasks online through a remote location but they also listen to employee queries, monitor their performances, and take appropriate actions. As a result, they don’t have enough time to complete payroll tasks, such as calculations, deductions, taxes, etc.

Using top payroll management services can help you mitigate these issues and streamline payroll activities. You would be able to communicate with your employees in an enhanced manner, answer their queries quickly, and find the time to cater to the unique requirements of remote working.

Let’s see how that is possible:

1. Accuracy

Your payroll management services can help you get the right numbers at the right time. You won’t get into trouble for dispatching the wrong salaries or sending out wrong taxes. You can rely on the technology and team of payroll management services in India to offer you accuracy – above all.

Here’s how that is possible:

Your team is focused on the payroll of your company and your team doesn’t have too much experience.

The payroll management service provider has an expert team. There are multiple subject matter experts who know how to correctly calculate payroll and taxes to avoid errors. Further, these experts have support from the latest tools, so they just need to recheck a few things to dispatch correct salaries, overtime pay, and taxes.

3. Cost-Efficiency

Let’s face it, as a small or medium organization. You don’t want to spend half of your income on building a huge payroll team. You don’t want to waste money on payroll technology just yet. All you can do is hire 2-3 employees and push them to work overtime so that you can maximize your profits and breakeven.

But, did you know that you don’t need to do any of this?

You can hire payroll management services in India and decide on your outsourcing package. Based on the services you take, you need to pay. It is a pay-as-per-your-use model. You get everything at a minimal cost. Your business is not responsible for paying the salaries and taxes of these employees.

This is possible because your payroll management service provider is serving multiple other businesses. They are able to divide the costs of experts and technology to offer you optimum services.

3. Time-Efficiency

Your HR department is not there to just calculate payroll and taxes. These people are called human resources for a reason – they are given the responsibility of managing your humans. Your employees make and break your company and your HR team manages these employees.

When you don’t use payroll management services, you are trapping your employees in a circle of data entry, calculations, errors, checking, and re-checking calculations. You are wasting your resources!

If you outsource payroll management, you are able to free up this team for improved execution. Your HR team is able to:

Encourage your employees

Understand their lower productivity phases

Offer them support when needed

Offer them guidance when needed

Onboard employees

Retain employees

Motivate employees to get through a low phase

4. Risk management

Above everything, your payroll management services help you manage the risk of non-compliance.

Since your payroll management service provider has a team to look after ongoing reforms and regulations, they are able to avoid compliance penalties. They also have automation systems to help you avoid errors in taxes and other calculations. So, your payroll management service in India can actually help you eliminate the risk of non-compliance or data loss. You can securely access your data and maintain compliance without making efforts.

Conclusion

For every organization, payroll is important. Payroll is challenging. They need to dispatch employee salaries, offer them benefits, and file taxes. However, in between all these tasks, the HR team somewhere loses control over other activities, such as employee motivation, encouragement, and engagement. To help your HR team focus more on people and lesser on calculations, utilize the best payroll management services.

Paysquare has customized packages for every type of business. We have an expert team to help you manage and streamline your big and small tasks of payroll challenges. For more details, reach out to us at [sales@paysquare.com].