Making money is a goal that many people aspire to achieve. While there is no guaranteed path to instant wealth, there are various ways you can increase your earning potential and work towards a more financially stable future. In this tutorial, we will outline a step-by-step approach to help you on your journey to making money.

Step 1: Set Clear Financial Goals

Before diving into any money-making endeavor, it is crucial to establish clear financial goals. Determine how much money you want to make and by when. Setting achievable and measurable goals will give you a clear direction and motivation to work towards.

Start by asking yourself what you want to achieve financially. Do you want to pay off debt, save for a specific purchase, or build long-term wealth? Understanding your goals will help you prioritize your efforts and make informed decisions.

Step 2: Identify Your Skills and Interests

Take some time to identify your skills, knowledge, and interests. What are you passionate about? What are you good at? Identifying your strengths will help you find opportunities where you can excel and potentially earn money.

Consider your professional skills, hobbies, and personal interests. You might find that your passion for photography or writing can be turned into a profitable business or freelance gig. By leveraging your strengths and interests, you can increase your chances of finding fulfilling money-making opportunities.

Step 3: Research Money-Making Opportunities

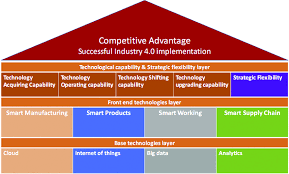

Once you have identified your skills and interests, research various money-making opportunities that align with them. This could include starting a business, freelancing, investing, or exploring different career paths. Look for opportunities that have the potential to provide a sustainable income.

In today’s digital age, there are countless online platforms and marketplaces that offer opportunities to make money. Whether it’s selling handmade crafts on Etsy, offering services on platforms like Upwork, or becoming an affiliate marketer, the options are endless. Consider the demand for your skills and the potential for growth in your chosen field.

Step 4: Develop Your Skills

To increase your earning potential, it’s important to continuously develop your skills. Take courses, attend workshops, or seek mentorship to enhance your knowledge and expertise. This will make you more valuable in the marketplace and open up new opportunities for earning money.

In addition to formal education, take advantage of online resources and communities related to your field of interest. Engage in networking activities, join professional organizations, and connect with like-minded individuals. Continued growth and learning will set you apart from others and make you more competitive in your chosen industry.

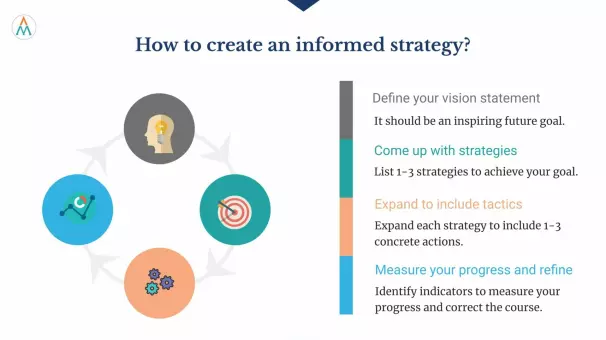

Step 5: Create a Financial Plan

Develop a comprehensive financial plan that includes budgeting, saving, and investing. Track your expenses, prioritize your spending, and start building an emergency fund. A solid financial plan will help you manage your money effectively and maximize your earning potential.

Consider consulting with a financial advisor to create a personalized plan tailored to your financial goals. They can provide guidance on investment opportunities, tax strategies, and risk management. Remember that a well-managed financial plan involves both short-term and long-term goals, so be sure to balance your spending and saving accordingly.

Step 6: Take Action and Start Earning

Now that you have set your goals, identified your skills, and created a financial plan, it’s time to take action and start earning. Whether it’s launching your own business, finding clients as a freelancer, investing in stocks, or pursuing a new career, take the necessary steps to put your plans into motion.

Start by creating a roadmap to guide your actions. Break down your goals into smaller, actionable steps. If you want to start a business, for example, research the legal requirements, develop a business plan, and start marketing your products or services. If you’re looking to invest, learn about different investment options and start small to gain experience and confidence.

Step 7: Learn from Your Experiences

As you embark on your money-making journey, learn from your experiences. Reflect on what works and what doesn’t, and make adjustments accordingly. Success may not come overnight, but by constantly learning and adapting, you can improve your chances of achieving your financial goals.

Keep track of your progress, analyze the outcomes of your efforts, and make necessary course corrections along the way. Seek feedback from customers, clients, or mentors to gain insights and identify areas for improvement. Remember, every setback or failure is an opportunity to learn and grow.

Ultimately, making money requires a combination of strategic planning, continuous learning, and diligent action. It’s important to stay motivated, stay focused on your goals, and never stop learning. With perseverance and determination, you can increase your earning potential and work towards financial freedom.

Note: This tutorial provides general advice and guidance on making money. It’s always recommended to consult with professionals or financial advisors for personalized advice based on your specific circumstances.